Our news

1 month ago

Home Conseil Relocation legal watch: March 2024

2 month ago

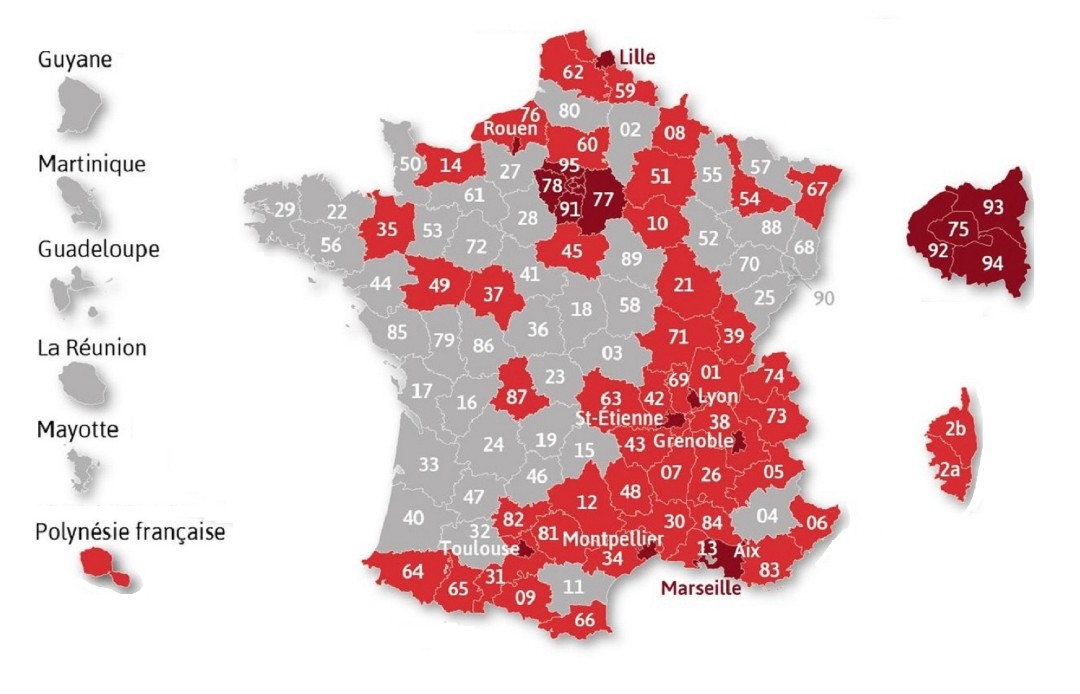

France's Immigration law: what real impacts on professional mobility?

4 month ago

Home Conseil Relocation pursues its commitment to Sustainable Development in 2023

6 month ago

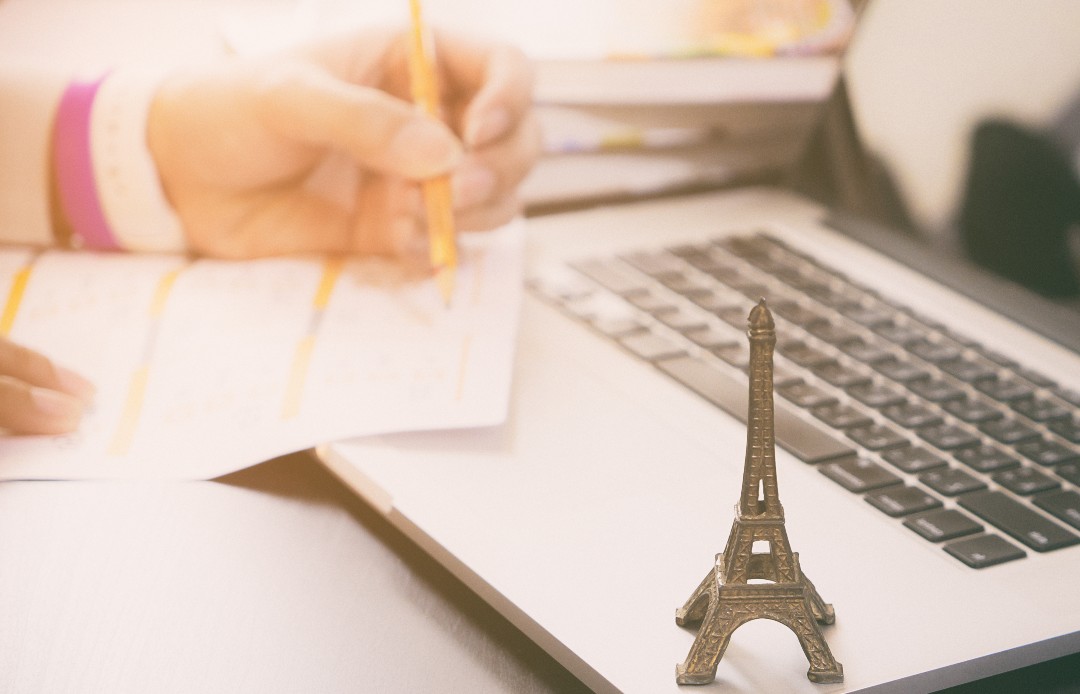

The Paris Rental Market Crisis: An Overview

1 year ago

Loosening of the EU directive on highly skilled jobs

1 year ago

The Carte Vitale app - a dematerialized alternative to the physical Carte Vitale

1 year ago

Assurance Maladie: Going Paperless in 2023

1 year ago

Fraudulent calls, emails and sms alerts

1 year ago

Transfer of the management of the employer's tax from the OFII to the DGFIP

1 year ago

Home Conseil Relocation is renewing its commitment to Sustainability

1 year ago

Home Conseil Relocation's new logo!

1 year ago

France Immigration News - December 2022

1 year ago

BREXIT: Options after the end of the transition period

2 years ago

France Immigration News - May 2022

2 years ago

Home Conseil Relocation secures a second quality certification!

2 years ago

Covid-19: New travel restrictions after the emergence of the Omicron variant

3 years ago

Home Conseil Relocation's commitment to Quality and Sustainability

3 years ago

The latest developments in professional immigration

3 years ago

Covid-19: France opens its borders opening to people who are vaccinated

3 years ago

Home Conseil Relocation is turning 30!

3 years ago

Streamlining of immigration procedures in France

3 years ago

Covid-19: France border opening for ''Green List'' countries

3 years ago

Covid-19: Third lockdown

3 years ago

Covid-19: New travel restrictions into France

4 years ago

Covid-19: Second lockdown

4 years ago

Covid-19: Curfew

4 years ago

BREXIT - The Platform for a Residence Permit Application is Online

4 years ago

Further border re-opening for ICT transferees

4 years ago

Partial border re-opening for holders of a Long Stay Visa bearing the mention 'Talent Passport'

4 years ago

Covid-19: Obligation to wear a mask outside

4 years ago

Covid-19: The 'red list' of countries for travelers to France

4 years ago

Overlooked immigration news since the end of lockdown in France

4 years ago

EU reopens its borders to 15 countries

4 years ago

Foreign driver’s license exchange: new measures taken by the French Government

4 years ago

End of lockdown and administrative activity in France

4 years ago

Covid-19: French administration decides to extend residence documents that would expire during the confinement

5 years ago

France is about to implement professionnal immigration quotas

5 years ago

BREXIT : British citizens procedure in case of a no deal

5 years ago

The latest measures about secondment in France

5 years ago

Is rent control coming back?

5 years ago

Unexpected difficulties for expatriates returning to France in obtaining health coverage

5 years ago

Focus on the “Asylum-Immigration“ law

5 years ago

Online validation of Long-Stay Visas as Resident Permits

5 years ago

Brexit: How to secure residence for British citizens in France?

5 years ago

Brexit: When to secure residency for British citizens in France?

5 years ago

No-deal Brexit is fast approaching

5 years ago

Tax withholding for newcomers in France

5 years ago

Home Conseil Relocation hopes that your dreams and aspirations will align in 2019

6 years ago

How to avoid the pitfalls of renting under a trial period in France

6 years ago

Recent changes to secondment in France

6 years ago

The strong impact on professional immigration processes of France’s new “Asylum-Immigration“ law

6 years ago

Brexit: The French Governement announces concrete steps to attract London’s finance

6 years ago

New European Directive on Posted Workers

6 years ago

What did we learn since the implementation of the new immigration law in november 2016?

6 years ago

Mobility lease: first hints unveiled

6 years ago

Home Conseil Relocation maintains its quality certification for 2018-2020 !

6 years ago

A message around Home Conseil Relocation’s transmission

6 years ago

Home Conseil Relocation wishes you a year full of energy and success

7 years ago

“Anatomy of the French Immigration Process” published in this month’s issue of Mobility Magazine

7 years ago

Home Conseil Relocation sends you its best wishes for 2017

8 years ago

Law N°2016-274 of March 7th, 2016: Application process with the French Consulates

8 years ago

Law N°2016-274 of March 7th, 2016: Immediate consequences of the decrees

8 years ago

Law N°2016-274 of March 7th, 2016: Publication of the implementation decrees

8 years ago

International provision of services – creation of a teleservice

8 years ago

New prolongation of the state of emergency

8 years ago

Useful factsheet to read before taking your car

8 years ago

BREXIT: To trigger or not to trigger the Article 50 of the Treaty on the EU ?

8 years ago

European Blue Card – raise of the minimum salary required

8 years ago

Cutting red tape: the European Commission wants to amend the European Blue Card Directive

8 years ago

Focus: Working nomads and Immigration

8 years ago

The new immigration law N°2016-274 was promulgated on March 7th, 2016, and published in the Official gazette.

8 years ago

Home Conseil Relocation maintains its quality certification for 2016-2018 !

8 years ago

New prolongation of the state of emergency

8 years ago

Adoption of the draft law to amend several provisions related to the control of immigration

8 years ago

Social Security: modification of the ‘beneficiary status’

8 years ago

Home Conseil Relocation wishes you A Happy New Year 2016

8 years ago

New rise of the indexed minimum wage from January 1st, 2016

9 years ago

No agreement on the Immigration draft law

9 years ago

Before the arrival in France, pay attention to the mention on the French visa !

9 years ago

Prolongation of the state of emergency

9 years ago

Border controls reintroduced after the terrorist attacks in Paris

9 years ago

Beware of fraudulent phone calls

9 years ago

Important modification of the French draft bill currently debated in the Parliament

9 years ago

Reminder: payment of the OFII tax is compulsory

9 years ago

Welcome to Lyon

9 years ago

European Blue Card – raise of the minimum salary required

9 years ago

Important specifications regarding the workers seconded to France

9 years ago

Resident permit for accompanying family with mention « private and family life »: 3-years card implemented

9 years ago

Change of status: a process shortened thanks to the suppression of the OFII medical exam

9 years ago

New rise of the indexed minimum wage since January 1st, 2015

9 years ago

Home Conseil Relocation wishes you a Happy 2015 and Dynamics

10 years ago

French government simplifies the administrative processes for workers posted temporarily by EU based employer

10 years ago

End of the summer: good news to know

10 years ago

Upcoming: Important changes in French policies

10 years ago

New Prime minister from the 1st of April 2014

10 years ago

Welcoming conditions at the Prefecture : foreseen improvements

10 years ago

Key legal aspects of same-sex marriage in France

10 years ago

Immigration: what to look for in 2014?

11 years ago

Biggest challenges faced by Expat moving to France

11 years ago

Latest amendments in Immigration law

11 years ago

What changes to come in Immigration law ?

11 years ago